That have rates of interest tipped to keep to increase along side future weeks and you may ages, we look at the facts about Australia’s mortgage loans and mention whether it is becoming much harder so you can provider the typical home loan.

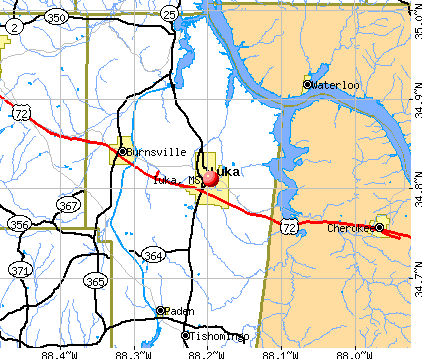

Average mortgage around australia by Condition

The average mortgage that is today nearly $600,000 may sound unbelievable in a few areas. Although not, explore one to figure to help you anybody off Melbourne, Canberra otherwise Sydney, plus they will most likely not believe you as the during these cities, the average the new financial is significantly high.

Mediocre mortgages around australia over time

Remarkably, the typical the brand new financial provides fell while the their peak in the off $617,608. The typical even offers dropped in the most common Claims and Territories over the period.

The greatest decline in the average mortgage has been around NSW, in https://paydayloanalabama.com/elberta/ which the mediocre new house mortgage is actually as much as $803,235 in the 1st day out of 2022.

Not surprisingly belong the common the new financial dimensions over the first 1 / 2 of 2022, you to pattern is obvious: the earlier your joined the business, the smaller your financial is actually more likely.

By way of example, the typical mortgage within the 2008 was only $243,600, or $144,five-hundred below it’s now. Within the March 1998 it was $114,700 as well as in February 1988 it had been simply $55,300.

Costs from the typical Australian Mortgage

An average Australian home loan possess increased dramatically so it today accounts for more 88% of your own average family rates, and that endured within $684,000 inside based on PropTrack.