Aly Yale are a freelance creator with well over ten years of experience coating a home and personal funds topics.

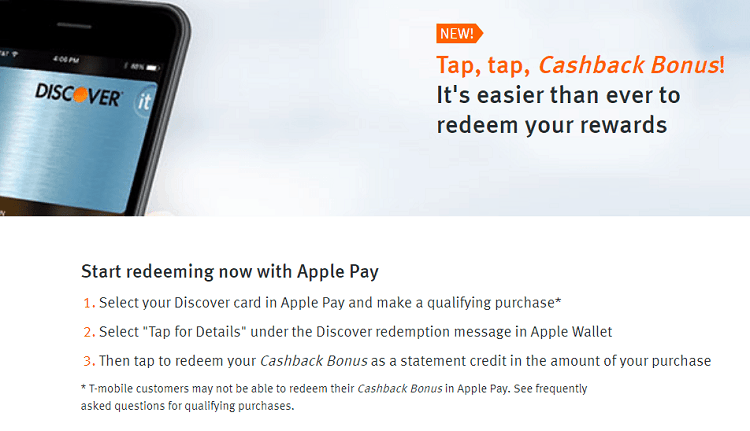

- 12-month repaired basic rate to have qualified individuals

- $0 app, origination, and assessment costs

- $0 settlement costs

- Transfer particular otherwise all your valuable HELOC to the a fixed-rates mortgage free-of-charge

- Closure may take half a dozen to help you 10 days, on average

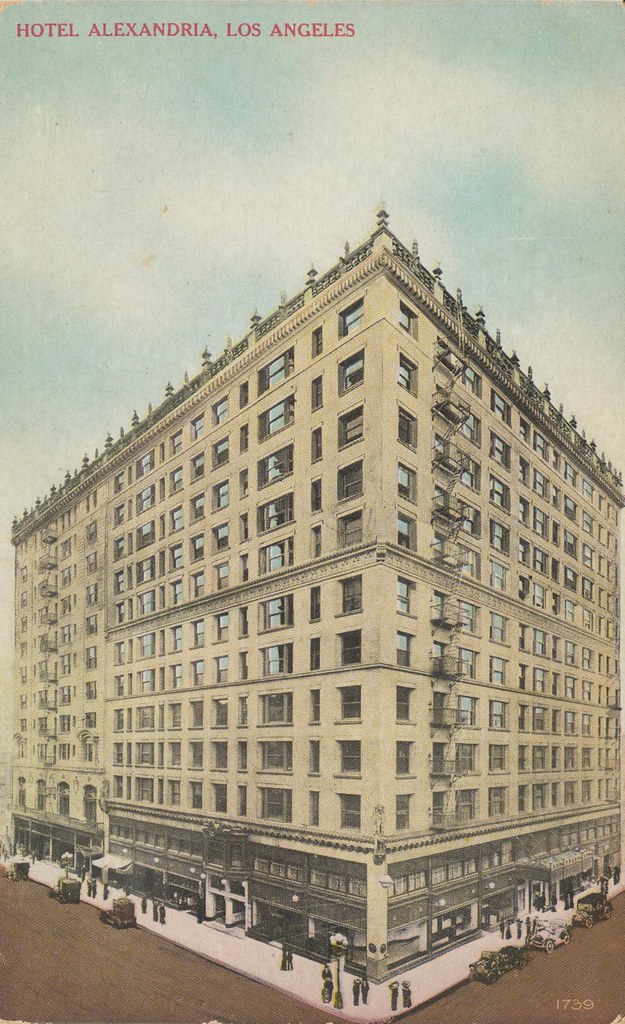

Bethpage Government Credit Union is actually a lending institution headquartered into the Enough time Area, Ny. It has multiple characteristics, as well as banking, financial financing, resource functions, and you may family security credit lines.

The financing relationship have over 29 cities over the Tri-County town, although it characteristics people regarding the nation. If you are considering using Bethpage to have a HELOC, this is what you have to know.

Bethpage also provides good HELOC which allows that change your house’s equity with the dollars. You should use funds from Bethpage’s HELOC for any purpose, as well as household renovations, merging personal debt, or spending expenses.

This new HELOC try Bethpage’s only house guarantee product. It doesn’t promote a standalone domestic guarantee loan, though it lets transforming specific or all of your HELOC into the a fixed-rate financing, the same as a property equity mortgage.

Benefits and drawbacks regarding an excellent Bethpage HELOC

Just like any bank, dealing with Bethpage has pros and cons. Definitely envision each party of one’s money before carefully deciding be it a great fit for your home collateral needs.

If you are looking having a loan provider to help with almost every other points of one’s monetary life, Bethpage’s of a lot qualities may help.

Bethpage’s HELOCs do not have software, origination, or appraisal costs. The financing relationship and additionally pays all the closing costs to have loan numbers lower than $500,000.