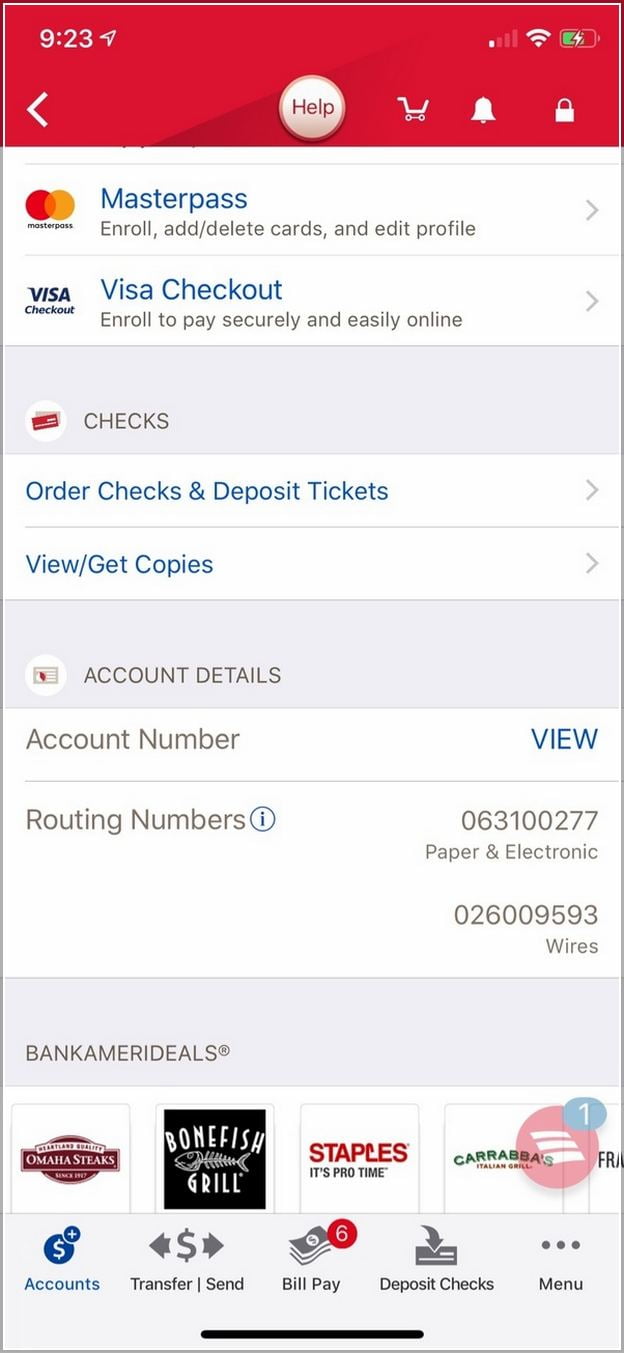

Projected payment and you can Annual percentage rate computation is actually created a predetermined-price ages of 5 years that’ll improvement in rate of interest twice a year for the next twenty five years of loan name, an all the way down-payment, or borrower security away from 25% and you will borrower-repaid finance charge away from 0.862% of the base loan amount, as well as origination charge if relevant. Following the five-season introductory several months: the newest Apr are adjustable and that is established a list plus an excellent margin. This new Annual percentage rate are different with a predetermined index referred to as Secured Right-away Financing Speed (SOFR). In the event the downpayment, or debtor equity are lower than 20%, mortgage insurance policies may be needed, that will improve the monthly payment additionally the ounts to have fees and insurance costs. You to transform increases or lower your payment per month.

This is not a credit decision otherwise an union in order to give

FHA estimated payment and you will ount having a 30-season name within mortgage loan off six.250% that have a deposit, or borrower equity out-of step 3.5% with no dismiss items bought carry out end up in a projected month-to-month dominant and you will interest commission away from $step one,663 along side full-term of your own mortgage having a yearly fee speed (APR) off 7.478%.

Projected payment per month and Annual percentage rate formula depend on an all the way down commission, otherwise debtor collateral off step 3.5% and you may debtor-paid back money fees of 0.862% of the legs loan amount. Projected payment and you can Apr assumes that initial mortgage insurance rates superior of $4,644 is actually funded to the loan amount. Brand new estimated payment found right here doesn’t come with the fresh new FHA-needed month-to-month mortgage cost, fees and you will insurance premiums, plus the real percentage responsibility could well be better.